Introduction to the Efficient Market Hypothesis (EMH)

The Efficient Market Hypothesis (EMH) is one of the most widely discussed theories in finance, and for good reason. It suggests that financial markets are “efficient,” meaning that prices of securities at any given time fully reflect all available information. So, whether you’re checking out stock prices, bonds, or even cryptocurrency, the theory suggests that all known data is already baked into the price, making it nearly impossible for investors to consistently outperform the market.

If you want to read same article in hindi click here

History and Origin of EMH

The Development of EMH

The origins of EMH date back to the early 20th century. However, it wasn’t until the 1960s that the hypothesis began gaining serious traction. Economists were intrigued by the concept that prices in the market reflect all available information. They studied how market participants, by collectively acting on available data, could push prices to an equilibrium point where no one could gain an advantage.

Eugene Fama’s Contribution

Eugene Fama, often regarded as the father of EMH, formally developed the hypothesis in the 1960s. In his research, he argued that it is impossible for investors to consistently achieve returns that outperform the overall market because any new information is quickly reflected in stock prices. His work revolutionized the way we think about investing and remains a cornerstone of modern finance.

Understanding the Concept of Market Efficiency

What is Market Efficiency?

Market efficiency refers to how well prices reflect all available information. In an efficient market, prices adjust almost instantly when new information becomes available. This efficiency is driven by competition among investors who strive to capitalize on any new data, thus eliminating the opportunity for others to make abnormal profits.

Different Levels of Efficiency

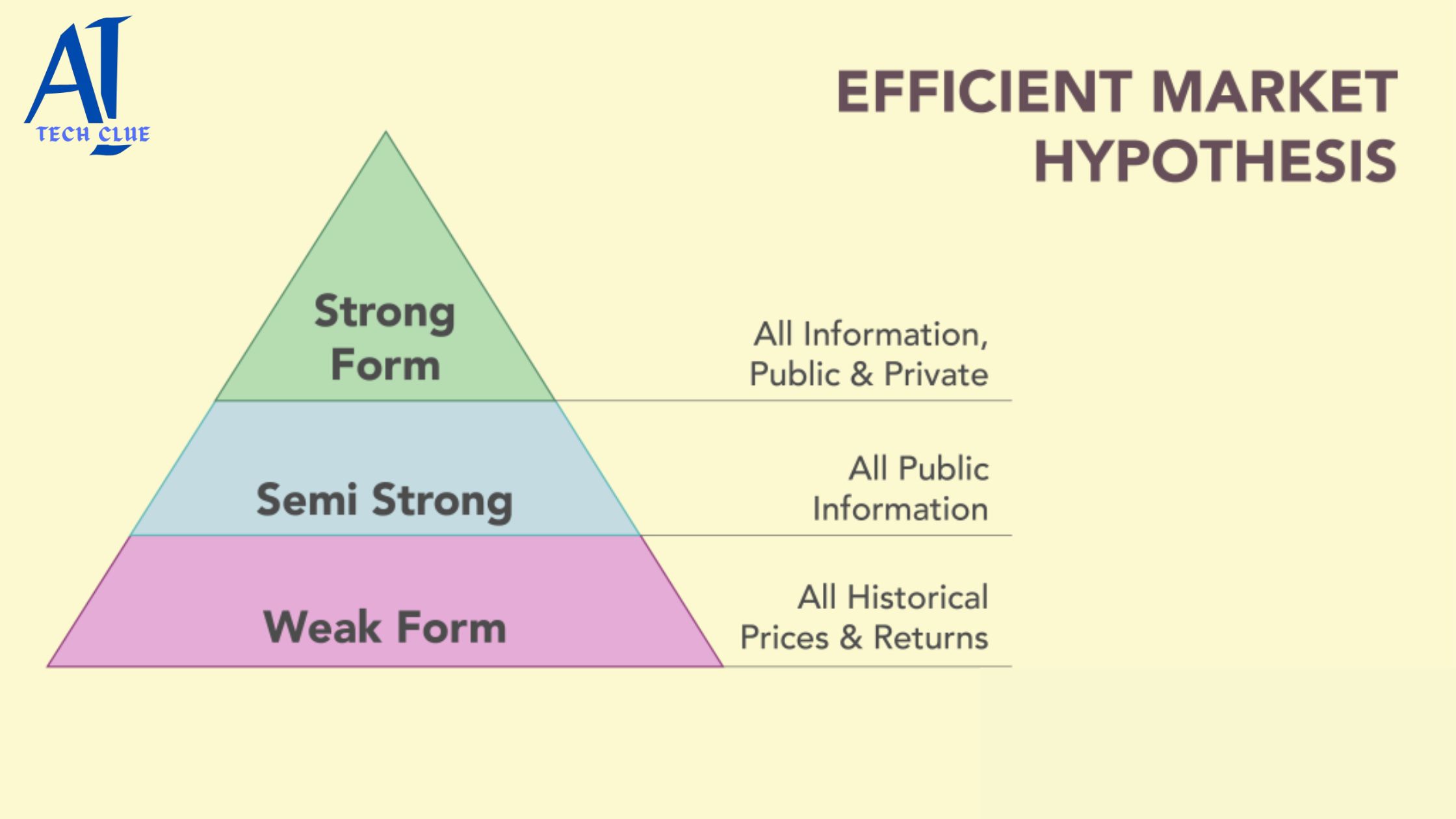

There are three levels of market efficiency, each depending on how much information is reflected in the asset prices:

- Weak-form efficiency – Only past price movements and volume data are reflected in asset prices.

- Semi-strong form efficiency – Prices reflect all publicly available information, such as news and financial reports.

- Strong-form efficiency – Prices reflect all information, both public and private, including insider knowledge.

Assumptions Behind the EMH

Rationality of Investors

A key assumption of EMH is that investors act rationally. This means they make decisions based on available information in a logical, unbiased manner. It assumes that irrational behavior, if it occurs, is quickly corrected by the actions of rational investors.

Information Accessibility

Another fundamental assumption is that information is freely available to all participants and that it is processed by investors at the same time. If information is easily accessible, prices should adjust rapidly.

Types of Efficient Market Hypothesis

Weak-form EMH

The weak form suggests that current prices reflect all historical data. This means that using technical analysis or charting past stock prices won’t give you an edge because that information is already included in the price.

Semi-strong form EMH

This form takes it a step further by stating that prices reflect all publicly available information. Whether it’s company earnings reports, news stories, or economic data, semi-strong EMH asserts that prices adjust quickly to new info, making fundamental analysis ineffective for predicting future price movements.

Strong-form EMH

The strong form is the most extreme. It argues that even insider information is reflected in stock prices. Therefore, no investor, even those with private or insider information, can consistently outperform the market.

Criticisms and Challenges to EMH

Behavioral Finance and Human Psychology

EMH has faced criticism, particularly from proponents of behavioral finance. Human psychology plays a significant role in market behavior. Investors often make decisions based on emotions such as fear and greed, leading to irrational price movements that contradict the assumptions of EMH.

Evidence of Anomalies and Irrational Behavior

Critics point to market anomalies, such as the dot-com bubble or the 2008 financial crisis, as evidence that markets are not always efficient. In these cases, prices deviated significantly from their intrinsic values due to irrational investor behavior.

The Role of Information in Market Efficiency

How Information Impacts Stock Prices

Information is the lifeblood of market efficiency. Whether it’s a new earnings report or global economic data, information affects investors’ perceptions of a company’s value, causing prices to adjust accordingly.

The Importance of Transparency

Transparency in financial markets ensures that all investors have equal access to information. Without transparency, certain participants could have an unfair advantage, leading to inefficiencies in the market.

Implications of EMH for Investors

Passive vs Active Investing Strategies

For investors, EMH implies that passive investment strategies, such as buying and holding index funds, are more effective than active strategies that try to time the market or pick individual stocks. If markets are truly efficient, active managers can’t consistently outperform the market after accounting for transaction costs.

Can Investors Beat the Market?

Under the EMH, consistently outperforming the market is nearly impossible because prices already incorporate all available information. While some may achieve short-term success, EMH suggests that over the long run, it’s highly unlikely.

EMH and Modern Portfolio Theory

Diversification and Risk Management

EMH is closely related to Modern Portfolio Theory (MPT), which advocates for diversification as a way to reduce risk without sacrificing returns. If markets are efficient, the best strategy is to hold a diversified portfolio that mirrors the market.

The Connection Between EMH and Portfolio Theory

MPT builds on the idea of efficient markets, suggesting that a well-diversified portfolio is the optimal way to achieve risk-adjusted returns. In an efficient market, stock picking is less important than maintaining proper asset allocation.

EMH in Practice

Real-World Applications of EMH

In the real world, EMH can be seen in the rapid adjustment of stock prices following major news events. For instance, when a company announces higher-than-expected earnings, its stock price tends to rise almost immediately, reflecting the new information.

Examples of Market Reactions to News

Consider how global markets react to political events, central bank decisions, or natural disasters. These reactions often occur in real-time, illustrating the principle of market efficiency.

Behavioral Finance vs EMH

How Cognitive Biases Affect Market Behavior

Behavioral finance challenges EMH by highlighting the role of cognitive biases in decision-making. Investors often exhibit herd behavior, overconfidence, and loss aversion, which can cause market prices to deviate from their true value.

Market Bubbles and Crashes

Events like market bubbles and crashes are examples of how psychological factors can drive prices far above or below their intrinsic value, calling into question the validity of EMH.

Empirical Evidence Supporting EMH

Studies That Validate EMH

Numerous academic studies support the EMH, showing that stock prices follow a random walk and that it’s impossible to predict future prices based on past performance. Index funds, which follow passive strategies, have also outperformed most active managers, lending further credibility to EMH.

Success Stories of Index Funds

The success of index funds, which aim to replicate the performance of the broader market rather than beat it, is a testament to the efficiency of financial markets. These funds often outperform actively managed funds due to their lower costs and the difficulty of consistently outperforming the market.

Empirical Evidence Against EMH

Market Anomalies and Irregularities

Despite the evidence supporting EMH, there are plenty of examples where markets behave inefficiently. Market anomalies, such as the January effect or momentum investing, show that certain patterns can persist, at least in the short term, allowing some investors to earn above-average returns.

Famous Cases Where EMH Failed

Examples like the 1987 Black Monday stock market crash, where prices dropped suddenly without any clear cause, raise questions about the validity of the EMH. Critics argue that such events indicate that markets are not always efficient and that irrational behavior plays a larger role than the hypothesis suggests.

Can the Market Ever Be Fully Efficient?

Limitations of Market Efficiency

While EMH offers a compelling framework, it’s not without limitations. Factors such as human emotion, political instability, and technological changes can create inefficiencies in the market that are difficult to account for.

External Factors Impacting the Market

External factors like government regulation, tax policies, and global trade agreements can introduce inefficiencies into the market, preventing it from achieving full efficiency.

Conclusion

The Efficient Market Hypothesis offers valuable insights into how financial markets operate, suggesting that prices reflect all available information and that it is difficult, if not impossible, for investors to consistently outperform the market. However, the theory is not without its critics, particularly from the field of behavioral finance, which argues that human emotions and cognitive biases often lead to market inefficiencies. Whether you believe in EMH or not, its impact on investment strategies, such as passive investing and diversification, cannot be denied.

Understanding the Capital Asset Pricing Model (CAPM)

Created with AIPRM Prompt “Human Written |100% Unique |SEO Optimised Article”

For better results, please try this: https://bit.ly/Jumma_GPTs

Get My Prompt Library: https://bit.ly/J_Umma

What is the Efficient Market Hypothesis (EMH)?

Outline

- Introduction to the Efficient Market Hypothesis (EMH)

- History and Origin of EMH

- The development of EMH

- Eugene Fama’s contribution

- Understanding the Concept of Market Efficiency

- What is market efficiency?

- Different levels of efficiency

- Assumptions Behind the EMH

- Rationality of investors

- Information accessibility

- Types of Efficient Market Hypothesis

- Weak-form EMH

- Historical data and market prices

- Semi-strong form EMH

- Publicly available information

- Strong-form EMH

- All information, including insider knowledge

- Weak-form EMH

- Criticisms and Challenges to EMH

- Behavioral finance and human psychology

- Evidence of anomalies and irrational behavior

- The Role of Information in Market Efficiency

- How information impacts stock prices

- The importance of transparency

- Implications of EMH for Investors

- Passive vs active investing strategies

- Can investors beat the market?

- EMH and Modern Portfolio Theory

- Diversification and risk management

- The connection between EMH and portfolio theory

- EMH in Practice

- Real-world applications of EMH

- Examples of market reactions to news

- Behavioral Finance vs EMH

- How cognitive biases affect market behavior

- Market bubbles and crashes

- Empirical Evidence Supporting EMH

- Studies that validate EMH

- Success stories of index funds

- Empirical Evidence Against EMH

- Market anomalies and irregularities

- Famous cases where EMH failed

- Can the Market Ever Be Fully Efficient?

- Limitations of market efficiency

- External factors impacting the market

- Conclusion

- FAQs

- What are the three forms of EMH?

- Is it possible to outperform the market?

- How does behavioral finance challenge EMH?

- What is the difference between active and passive investing?

- Does EMH apply to cryptocurrency markets?

What is the Efficient Market Hypothesis (EMH)?

Introduction to the Efficient Market Hypothesis (EMH)

The Efficient Market Hypothesis (EMH) is one of the most widely discussed theories in finance, and for good reason. It suggests that financial markets are “efficient,” meaning that prices of securities at any given time fully reflect all available information. So, whether you’re checking out stock prices, bonds, or even cryptocurrency, the theory suggests that all known data is already baked into the price, making it nearly impossible for investors to consistently outperform the market.

History and Origin of EMH

The Development of EMH

The origins of EMH date back to the early 20th century. However, it wasn’t until the 1960s that the hypothesis began gaining serious traction. Economists were intrigued by the concept that prices in the market reflect all available information. They studied how market participants, by collectively acting on available data, could push prices to an equilibrium point where no one could gain an advantage.

Eugene Fama’s Contribution

Eugene Fama, often regarded as the father of EMH, formally developed the hypothesis in the 1960s. In his research, he argued that it is impossible for investors to consistently achieve returns that outperform the overall market because any new information is quickly reflected in stock prices. His work revolutionized the way we think about investing and remains a cornerstone of modern finance.

Understanding the Concept of Market Efficiency

What is Market Efficiency?

Market efficiency refers to how well prices reflect all available information. In an efficient market, prices adjust almost instantly when new information becomes available. This efficiency is driven by competition among investors who strive to capitalize on any new data, thus eliminating the opportunity for others to make abnormal profits.

Different Levels of Efficiency

There are three levels of market efficiency, each depending on how much information is reflected in the asset prices:

- Weak-form efficiency – Only past price movements and volume data are reflected in asset prices.

- Semi-strong form efficiency – Prices reflect all publicly available information, such as news and financial reports.

- Strong-form efficiency – Prices reflect all information, both public and private, including insider knowledge.

Assumptions Behind the EMH

Rationality of Investors

A key assumption of EMH is that investors act rationally. This means they make decisions based on available information in a logical, unbiased manner. It assumes that irrational behavior, if it occurs, is quickly corrected by the actions of rational investors.

Information Accessibility

Another fundamental assumption is that information is freely available to all participants and that it is processed by investors at the same time. If information is easily accessible, prices should adjust rapidly.

Types of Efficient Market Hypothesis

Weak-form EMH

The weak form suggests that current prices reflect all historical data. This means that using technical analysis or charting past stock prices won’t give you an edge because that information is already included in the price.

Semi-strong form EMH

This form takes it a step further by stating that prices reflect all publicly available information. Whether it’s company earnings reports, news stories, or economic data, semi-strong EMH asserts that prices adjust quickly to new info, making fundamental analysis ineffective for predicting future price movements.

Strong-form EMH

The strong form is the most extreme. It argues that even insider information is reflected in stock prices. Therefore, no investor, even those with private or insider information, can consistently outperform the market.

Criticisms and Challenges to EMH

Behavioral Finance and Human Psychology

EMH has faced criticism, particularly from proponents of behavioral finance. Human psychology plays a significant role in market behavior. Investors often make decisions based on emotions such as fear and greed, leading to irrational price movements that contradict the assumptions of EMH.

Evidence of Anomalies and Irrational Behavior

Critics point to market anomalies, such as the dot-com bubble or the 2008 financial crisis, as evidence that markets are not always efficient. In these cases, prices deviated significantly from their intrinsic values due to irrational investor behavior.

The Role of Information in Market Efficiency

How Information Impacts Stock Prices

Information is the lifeblood of market efficiency. Whether it’s a new earnings report or global economic data, information affects investors’ perceptions of a company’s value, causing prices to adjust accordingly.

The Importance of Transparency

Transparency in financial markets ensures that all investors have equal access to information. Without transparency, certain participants could have an unfair advantage, leading to inefficiencies in the market.

Implications of EMH for Investors

Passive vs Active Investing Strategies

For investors, EMH implies that passive investment strategies, such as buying and holding index funds, are more effective than active strategies that try to time the market or pick individual stocks. If markets are truly efficient, active managers can’t consistently outperform the market after accounting for transaction costs.

Can Investors Beat the Market?

Under the EMH, consistently outperforming the market is nearly impossible because prices already incorporate all available information. While some may achieve short-term success, EMH suggests that over the long run, it’s highly unlikely.

EMH and Modern Portfolio Theory

Diversification and Risk Management

EMH is closely related to Modern Portfolio Theory (MPT), which advocates for diversification as a way to reduce risk without sacrificing returns. If markets are efficient, the best strategy is to hold a diversified portfolio that mirrors the market.

The Connection Between EMH and Portfolio Theory

MPT builds on the idea of efficient markets, suggesting that a well-diversified portfolio is the optimal way to achieve risk-adjusted returns. In an efficient market, stock picking is less important than maintaining proper asset allocation.

EMH in Practice

Real-World Applications of EMH

In the real world, EMH can be seen in the rapid adjustment of stock prices following major news events. For instance, when a company announces higher-than-expected earnings, its stock price tends to rise almost immediately, reflecting the new information.

Examples of Market Reactions to News

Consider how global markets react to political events, central bank decisions, or natural disasters. These reactions often occur in real-time, illustrating the principle of market efficiency.

Behavioral Finance vs EMH

How Cognitive Biases Affect Market Behavior

Behavioral finance challenges EMH by highlighting the role of cognitive biases in decision-making. Investors often exhibit herd behavior, overconfidence, and loss aversion, which can cause market prices to deviate from their true value.

Market Bubbles and Crashes

Events like market bubbles and crashes are examples of how psychological factors can drive prices far above or below their intrinsic value, calling into question the validity of EMH.

Empirical Evidence Supporting EMH

Studies That Validate EMH

Numerous academic studies support the EMH, showing that stock prices follow a random walk and that it’s impossible to predict future prices based on past performance. Index funds, which follow passive strategies, have also outperformed most active managers, lending further credibility to EMH.

Success Stories of Index Funds

The success of index funds, which aim to replicate the performance of the broader market rather than beat it, is a testament to the efficiency of financial markets. These funds often outperform actively managed funds due to their lower costs and the difficulty of consistently outperforming the market.

Empirical Evidence Against EMH

Market Anomalies and Irregularities

Despite the evidence supporting EMH, there are plenty of examples where markets behave inefficiently. Market anomalies, such as the January effect or momentum investing, show that certain patterns can persist, at least in the short term, allowing some investors to earn above-average returns.

Famous Cases Where EMH Failed

Examples like the 1987 Black Monday stock market crash, where prices dropped suddenly without any clear cause, raise questions about the validity of the EMH. Critics argue that such events indicate that markets are not always efficient and that irrational behavior plays a larger role than the hypothesis suggests.

Can the Market Ever Be Fully Efficient?

Limitations of Market Efficiency

While EMH offers a compelling framework, it’s not without limitations. Factors such as human emotion, political instability, and technological changes can create inefficiencies in the market that are difficult to account for.

External Factors Impacting the Market

External factors like government regulation, tax policies, and global trade agreements can introduce inefficiencies into the market, preventing it from achieving full efficiency.

Conclusion

The Efficient Market Hypothesis offers valuable insights into how financial markets operate, suggesting that prices reflect all available information and that it is difficult, if not impossible, for investors to consistently outperform the market. However, the theory is not without its critics, particularly from the field of behavioral finance, which argues that human emotions and cognitive biases often lead to market inefficiencies. Whether you believe in EMH or not, its impact on investment strategies, such as passive investing and diversification, cannot be denied.

FAQs

- What are the three forms of EMH?

The three forms of EMH are weak-form, semi-strong form, and strong-form, each reflecting different levels of information being reflected in asset prices. - Is it possible to outperform the market?

According to EMH, it is extremely difficult to outperform the market consistently because all available information is already reflected in prices. - How does behavioral finance challenge EMH?

Behavioral finance challenges EMH by showing that human emotions, such as fear and greed, can cause irrational behavior, leading to market inefficiencies. - What is the difference between active and passive investing?

Active investing involves trying to pick stocks and time the market, while passive investing involves holding a diversified portfolio that mirrors the overall market. - Does EMH apply to cryptocurrency markets?

While EMH can theoretically apply to any market, including cryptocurrency, the high volatility and speculation in crypto markets suggest that they may not be as efficient as traditional financial markets.