Introduction to the Capital Asset Pricing Model (CAPM)

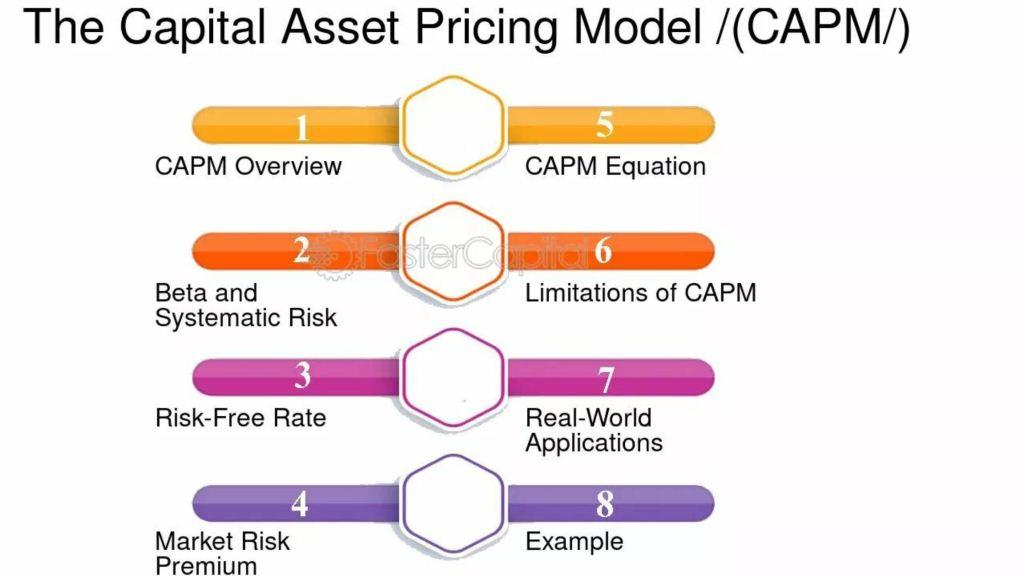

The Capital Asset Pricing Model (CAPM) is a financial model that establishes a relationship between risk and expected return. It’s widely used by investors to determine the appropriate required return for an asset, considering its risk in relation to the overall market. CAPM assumes that investors need to be compensated for both the time value of money (the risk-free rate) and the risk associated with the investment (market risk).

In simple terms, CAPM helps investors assess whether a stock is worth investing in by comparing its potential returns to the amount of risk it carries. Understanding CAPM can provide valuable insights into investment decisions, asset pricing, and portfolio management.

If you want to read same article in hindi click here

The Origins of CAPM

The Capital Asset Pricing Model was developed in the 1960s by William F. Sharpe, along with John Lintner and Jack Treynor, who built on earlier work by Harry Markowitz on portfolio theory. Sharpe’s contribution to CAPM earned him a Nobel Prize in Economics in 1990.

CAPM emerged as an extension of Markowitz’s Modern Portfolio Theory, which emphasized diversification as a way to minimize risk. CAPM takes this concept further by showing how an individual asset contributes to the overall risk of a well-diversified portfolio.

The Core Formula of CAPM

The CAPM formula is central to the model, and it can be expressed as:

[

\text{Expected Return (ER)} = R_f + \beta (R_m – R_f)

]

Where:

- ER is the expected return of the asset

- R_f is the risk-free rate (such as government bonds)

- β (Beta) measures the volatility of the asset relative to the overall market

- R_m is the expected return of the market

- (R_m – R_f) is the market risk premium

Each component of this equation plays a crucial role in determining the expected return of an asset based on its risk level.

Risk and Return: The Foundation of CAPM

At the heart of CAPM is the trade-off between risk and return. The model assumes that investors are risk-averse, meaning they require higher returns to compensate for taking on more risk. This is why CAPM includes the risk-free rate—the return an investor can expect from a completely risk-free investment, like a government bond.

The market risk premium represents the additional return investors expect to earn by taking on the risk of investing in the stock market rather than risk-free assets.

Understanding Beta (β) in CAPM

Beta (β) is one of the most critical components of the CAPM formula. It measures an asset’s volatility relative to the overall market. A beta of 1 means the asset moves in line with the market. A beta greater than 1 indicates that the asset is more volatile than the market, while a beta less than 1 means the asset is less volatile.

For example, a stock with a beta of 1.5 is expected to move 50% more than the market. If the market goes up by 10%, the stock should go up by 15%, and if the market goes down by 10%, the stock should fall by 15%.

The Role of Market Risk Premium

The market risk premium is the difference between the expected return of the market and the risk-free rate. It reflects the additional return investors expect to receive for investing in the stock market rather than in safer, risk-free securities.

The higher the market risk premium, the greater the return investors demand for taking on market risk. The market risk premium can vary depending on economic conditions, investor sentiment, and historical market performance.

Assumptions of the CAPM

CAPM relies on several key assumptions, which may not always hold in the real world:

- Investors are rational and risk-averse – They make decisions based on expected returns and risk.

- Markets are efficient – All investors have access to the same information, and stock prices fully reflect all available information.

- No transaction costs or taxes – CAPM assumes a frictionless market where trading has no costs.

- Investors hold diversified portfolios – CAPM assumes that investors hold portfolios that eliminate unsystematic (diversifiable) risk, leaving only market risk.

While these assumptions may simplify the model, they also create limitations when applying CAPM to real-world scenarios.

How CAPM Helps in Portfolio Management

The CAPM is a valuable tool in portfolio management, especially when it comes to calculating the expected return of an asset. By considering an asset’s beta, CAPM allows investors to estimate the appropriate compensation for the risk associated with that asset compared to the risk-free rate.

In practice, this helps portfolio managers decide whether a particular stock or asset is worth adding to a portfolio based on its expected return and contribution to overall risk.

Advantages of the CAPM

There are several advantages to using CAPM:

- Simplicity – CAPM provides a straightforward way to calculate an asset’s expected return based on risk.

- Diversification – CAPM emphasizes the importance of diversification and the relationship between market risk and return.

- Universal applicability – CAPM can be applied across various asset classes, making it a versatile model for pricing financial instruments.

Criticisms and Limitations of CAPM

Despite its widespread use, CAPM has several limitations:

- Unrealistic assumptions – The model assumes perfect markets, rational investors, and no taxes or transaction costs, which rarely apply in real-world markets.

- Beta’s limitations – Beta only captures market risk, not the risk of an individual asset, and it is backward-looking, relying on historical data that may not predict future performance.

- Static model – CAPM assumes a single-period investment horizon, which can be limiting for long-term investors.

CAPM vs. Other Models

While CAPM is widely used, it has competitors, such as the Fama-French Three-Factor Model. This model expands on CAPM by incorporating additional factors like size and value to explain asset returns better. Unlike CAPM, which only considers market risk, the Fama-French model accounts for other risks that can affect stock performance.

Real-World Applications of CAPM

In practice, companies often use CAPM to calculate their cost of equity when evaluating new projects or determining discount rates for cash flow models. It helps businesses understand the risk-return trade-off and make more informed capital budgeting decisions.

CAPM and Stock Valuation

CAPM plays a crucial role in stock valuation, helping analysts determine whether a stock is fairly priced based on its risk and expected return. By comparing a stock’s expected return with its required return (calculated using CAPM), analysts can assess whether the stock is over- or undervalued.

The Impact of CAPM on Modern Finance

The Capital Asset Pricing Model has had a profound influence on modern finance. It has become an essential tool for understanding risk and return and continues to be used by investors, financial analysts, and corporations around the world. CAPM’s principles underpin

much of modern portfolio theory and corporate finance.

Conclusion

In summary, the Capital Asset Pricing Model (CAPM) is a fundamental financial model that helps investors understand the relationship between risk and return. While it has its limitations and assumptions, CAPM remains an essential tool for valuing assets, managing portfolios, and making informed investment decisions. As financial markets evolve, CAPM continues to be a cornerstone of modern financial theory.

What is the Efficient Market Hypothesis (EMH)

Frequently Asked Questions (FAQs)

- What is the main purpose of CAPM?

CAPM is used to determine the expected return of an asset based on its risk compared to the overall market. - What is Beta in CAPM?

Beta measures an asset’s volatility relative to the market. A beta higher than 1 indicates more volatility, while a beta lower than 1 means less volatility. - Why do investors use CAPM?

Investors use CAPM to assess whether an investment provides adequate returns for its level of risk. - What are the limitations of CAPM?

CAPM assumes perfect markets, rational investors, and no transaction costs, which are unrealistic in the real world. - Is CAPM still relevant today?

Yes, despite criticisms, CAPM remains widely used in finance for calculating the expected return of assets and managing portfolios.

1 thought on “Understanding the Capital Asset Pricing Model (CAPM)”