Introduction to Behavioral Finance

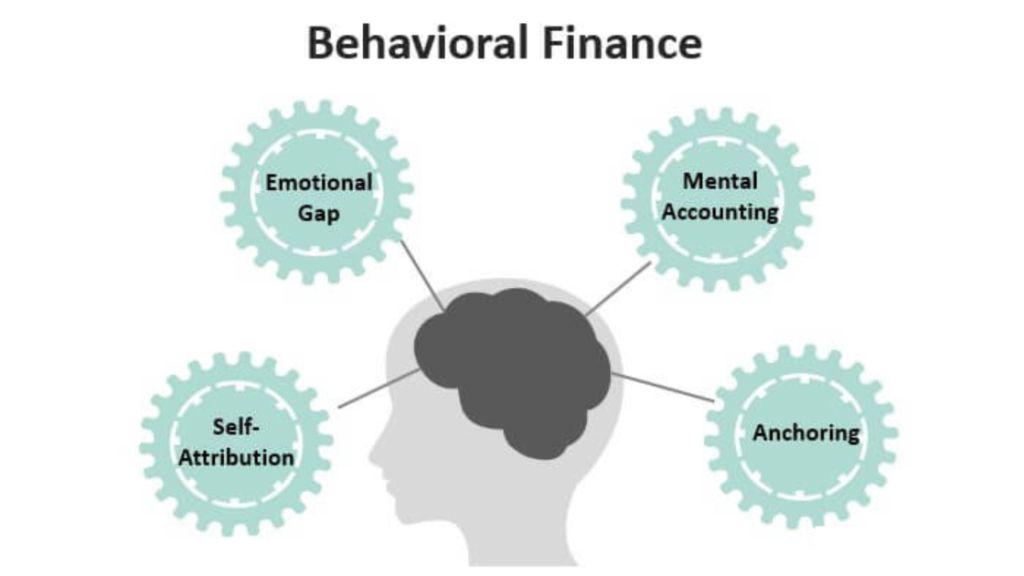

Behavioral finance is the study of how human psychology affects financial decisions, particularly in the stock market. Unlike traditional finance, which assumes that people are always rational and logical, behavioral finance acknowledges that we often make decisions based on emotions, biases, and irrational thought processes. This is especially important when it comes to the stock market, where investor behavior can lead to big swings in prices, bubbles, and crashes.

If you want to read same article in hindi click here

Behavioral Finance vs Traditional Finance

Traditional finance is built on the belief that the market is efficient. According to the efficient market hypothesis (EMH), all available information is reflected in stock prices, and investors make rational decisions based on that information. This means that no one can consistently outperform the market.

Behavioral finance, on the other hand, says that’s not always true. People aren’t perfectly rational; we’re influenced by emotions, cognitive biases, and social factors. These human tendencies can lead to decisions that don’t always align with logic, causing market inefficiencies. So while traditional finance focuses on numbers and data, behavioral finance looks at the human side of investing.

Investor Psychology

Investor psychology plays a huge role in how people make decisions in the stock market. We like to think we’re making rational, well-thought-out choices, but in reality, our minds are often influenced by subconscious biases and emotions.

Cognitive Biases in Decision-Making

Cognitive biases are mental shortcuts that can lead us astray. Instead of making decisions based purely on facts and figures, we rely on our past experiences or certain patterns we’ve seen before—this can cause us to make poor investment choices.

Emotional Factors in Investing

Emotions like fear and greed can have a powerful impact on investment decisions. Fear can make us sell stocks during a market dip when we should hold, while greed can push us to buy stocks during a boom, right before prices fall.

Common Behavioral Biases in the Stock Market

Overconfidence Bias

Overconfidence bias is when investors think they know more than they really do. They believe they can time the market or pick the best stocks, but this overconfidence often leads to poor decisions and increased risk.

Herd Mentality

Herd mentality is the tendency to follow the crowd. If everyone else is buying or selling a stock, we’re likely to do the same, even if it goes against our own analysis. This kind of behavior often leads to market bubbles and crashes.

Anchoring Bias

Anchoring bias occurs when investors fixate on a particular piece of information, like a stock’s previous high price, and use it as a reference point for future decisions—even if it’s no longer relevant.

Loss Aversion

Loss aversion is the idea that people feel the pain of losing money more than the joy of gaining money. This bias can lead investors to hold onto losing stocks for too long, hoping to recover their losses, instead of cutting their losses and moving on.

Emotions in Stock Market Decisions

Fear and greed are the two most powerful emotions in the stock market. Fear can lead to panic selling when markets drop, while greed can cause people to buy stocks at unsustainable prices, fueling market bubbles. Investors often find themselves on an emotional rollercoaster, chasing after profits and trying to avoid losses.

Behavioral Finance Theories

Prospect Theory

Prospect theory suggests that people evaluate potential losses and gains differently. Investors tend to fear losses more than they value gains, which can lead them to make overly conservative or irrational decisions.

Mental Accounting

Mental accounting is when investors mentally separate their money into different “accounts” based on where it came from or what it’s for, which can lead to irrational spending or investment behavior.

Herd Behavior Theory

Herd behavior theory explains why investors often follow the crowd. In times of uncertainty, people feel safer doing what everyone else is doing, even if it’s not the smartest move.

Behavioral Finance and Market Bubbles/Crashes

Behavioral finance helps explain why market bubbles and crashes happen. When investors collectively fall into biases like overconfidence or herd mentality, it can drive stock prices to extreme levels. This can lead to bubbles, where prices are inflated beyond their actual value, and crashes, where prices suddenly plummet.

Case Study: The Dot-com Bubble

The dot-com bubble in the late 1990s is a classic example of behavioral finance in action. Investors were overly confident about the potential of internet companies, which led to a massive surge in tech stock prices. Herd mentality kicked in as more and more people rushed to invest, even in companies with no real revenue. Eventually, the bubble burst, and many investors suffered huge losses.

Practical Applications of Behavioral Finance

Improving Personal Investment Strategies

Understanding behavioral finance can help you make better investment decisions. For example, being aware of biases like loss aversion can prevent you from holding onto losing investments for too long.

Role of Financial Advisors

Financial advisors can help mitigate the impact of behavioral biases. By providing objective advice and helping you stay focused on long-term goals, they can keep you from making emotional or irrational decisions.

Technology’s Impact on Investor Behavior

With the rise of algorithmic trading and the influence of social media, investors today are more susceptible to emotional decisions than ever. Algorithmic trading can cause sudden shifts in the market, while social media can amplify trends and lead to herd mentality, with investors rushing to follow the latest “hot stock.”

Overcoming Behavioral Biases

Staying Disciplined in Investing

One of the best ways to overcome behavioral biases is to stick to a disciplined investment strategy. Set clear goals, diversify your portfolio, and avoid making impulsive decisions based on short-term market movements.

Why Diversification is Key

Diversification helps spread risk across different investments, reducing the impact of any single bias or emotional decision. By not putting all your eggs in one basket, you’re better able to ride out market ups and downs.

Long-Term Investing vs Short-Term Thinking

Behavioral finance supports the idea of long-term investing over short-term speculation. By focusing on the long term, you can avoid the emotional pitfalls of trying to time the market or chase quick profits.

Behavioral Finance in Modern Investment Strategies

Many investment strategies today incorporate behavioral finance principles to improve performance. Mutual funds and ETFs are often designed to account for investor psychology, helping to minimize emotional decisions and focus on long-term growth.

Behavioral Finance and Risk Management

Understanding your own risk tolerance and how behavioral biases influence it is key to managing risk. By being aware of these factors, you can make smarter, more

balanced decisions that align with your financial goals.

Criticism of Behavioral Finance

Some critics argue that behavioral finance lacks the precision of traditional finance models and that it can be hard to predict exactly how emotions will affect market outcomes. However, many experts agree that combining both behavioral and traditional finance provides a more complete picture of investor behavior.

Conclusion

Behavioral finance shines a light on the psychological factors that influence stock market decisions. By recognizing and addressing biases like overconfidence, herd mentality, and loss aversion, investors can make more informed, rational choices. Whether you’re an individual investor or managing a large portfolio, understanding behavioral finance can help you navigate the emotional ups and downs of the stock market and improve your long-term financial success.

How to Spot Emerging Market Trends Before Everyone Else

FAQs

1: What is behavioral finance, and how is it different from traditional finance?

Behavioral finance looks at the psychological factors that affect financial decisions, while traditional finance assumes investors are always rational and logical.

2: How do biases affect my stock market decisions?

Biases like overconfidence or loss aversion can lead to poor decisions, such as trading too much or holding onto losing investments.

3: Can emotions really mess up my investments?

Yes, emotions like fear and greed can cause you to buy or sell at the wrong time, negatively impacting your financial outcomes.

4: How can I avoid emotional mistakes in the stock market?

You can stick to a disciplined strategy, diversify your portfolio, and focus on long-term goals to avoid emotional investment decisions.

5: Is behavioral finance helpful for long-term investing?

Definitely! Behavioral finance helps investors avoid short-term emotional mistakes and encourages long-term, rational decision-making.

1 thought on “The role of behavioral finance in stock market decisions”