Investing can be a powerful tool for building wealth, but it’s crucial to create a strategy that aligns with your personal risk tolerance. Everyone has a different level of comfort when it comes to handling the ups and downs of the market, and understanding your own risk tolerance will help you make smarter decisions that match your financial goals. In this guide, we’ll walk you through how to create an investment strategy tailored to your risk tolerance.

If you want to read same article in hindi click here

1. Understanding Risk Tolerance

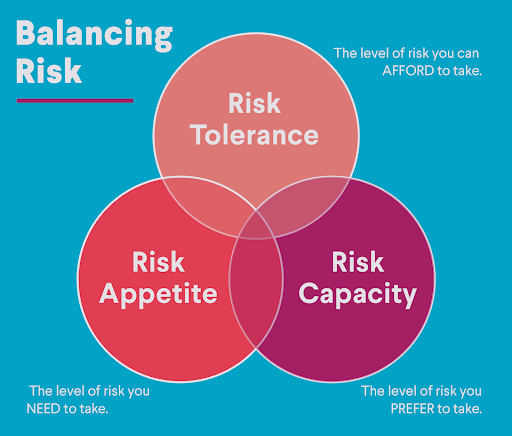

Before crafting your investment strategy, it’s essential to understand what risk tolerance means. Risk tolerance refers to the amount of volatility and potential loss an investor is willing to accept in their portfolio. It’s influenced by factors such as your age, financial goals, investment timeline, and emotional response to market changes.

- Aggressive investors: Comfortable with higher risks for the potential of higher returns.

- Moderate investors: Willing to accept some risk but prefer a balanced approach.

- Conservative investors: Prioritize capital preservation and are uncomfortable with significant risk.

2. Assessing Your Personal Risk Tolerance

To determine your risk tolerance, consider the following factors:

Age and Investment Horizon

- Younger investors typically have a higher risk tolerance because they have more time to recover from market downturns. They can afford to invest in riskier assets like stocks.

- Older investors nearing retirement often prefer safer, more stable investments to protect their wealth.

Financial Goals

- Short-term goals, like buying a house in the next few years, call for lower-risk investments to ensure the money is available when needed.

- Long-term goals, such as saving for retirement or building generational wealth, allow for a higher risk tolerance since there’s more time for the market to rebound.

Emotional Response to Risk

- How do you react during market downturns? If stock market fluctuations make you anxious or lead to rash decisions, a more conservative approach might suit you better.

- If you’re calm and patient during periods of volatility, you might be more comfortable with riskier investments.

3. Types of Investment Strategies Based on Risk Tolerance

Your risk tolerance will help guide the types of assets you include in your investment portfolio. Below are investment strategies for each risk profile:

Aggressive Strategy (High Risk Tolerance)

An aggressive strategy is for investors who are willing to tolerate significant short-term losses in exchange for the potential of high long-term returns. This strategy typically focuses on:

- Stocks: The bulk of the portfolio is in equities, particularly growth stocks or international markets with high growth potential.

- Sector-specific funds: Investing in emerging sectors like technology or biotech.

- Cryptocurrency: For those open to more speculative investments, a small allocation might go into cryptocurrencies or other high-risk assets.

Moderate Strategy (Medium Risk Tolerance)

A moderate strategy balances growth potential with risk management. It’s suitable for investors who want some exposure to the stock market but also value stability.

- 60/40 portfolio: A typical moderate strategy involves allocating 60% to stocks and 40% to bonds.

- Dividend-paying stocks: These stocks offer some growth potential but provide income through dividends, reducing the overall risk.

- Real estate: Some investors might diversify into real estate or Real Estate Investment Trusts (REITs) for stable, long-term returns.

Conservative Strategy (Low Risk Tolerance)

A conservative investment strategy is focused on preserving capital and minimizing risk. It’s ideal for investors who prioritize security over high returns.

- Bonds: A large portion of the portfolio is invested in bonds, which are considered safer than stocks.

- Money market accounts: These accounts offer very low risk, though they also provide lower returns.

- High-quality dividend stocks: These offer some growth but with less volatility compared to growth stocks.

4. Diversification: A Key to Managing Risk

Regardless of your risk tolerance, diversification is crucial. Diversification means spreading your investments across different asset classes, such as stocks, bonds, and real estate, to reduce risk. Even within the same asset class, you should diversify by investing in different sectors or geographies.

- Stocks: Invest in a mix of large-cap, mid-cap, and small-cap companies.

- Bonds: Consider diversifying between government bonds, corporate bonds, and international bonds.

- Real estate: Adding real estate to your portfolio can help balance stock market volatility.

By diversifying, you can protect yourself from significant losses in any one area, which is especially important for more conservative investors.

5. Creating a Balanced Portfolio

Once you’ve assessed your risk tolerance, it’s time to build a balanced portfolio that matches your risk profile. A well-balanced portfolio reflects your risk tolerance while positioning you to meet your financial goals.

Aggressive Portfolio Example

- 80% stocks (including international and emerging markets)

- 15% bonds

- 5% alternative investments (e.g., cryptocurrency or commodities)

Moderate Portfolio Example

- 60% stocks

- 30% bonds

- 10% real estate or REITs

Conservative Portfolio Example

- 30% stocks

- 60% bonds

- 10% in cash or money market funds

6. Rebalancing Your Portfolio Over Time

As you age and your financial goals evolve, your risk tolerance may change. It’s important to rebalance your portfolio periodically to ensure it still aligns with your current risk tolerance and goals.

- Rebalancing means adjusting your asset allocation to maintain the right balance between risk and reward. For instance, if stocks have done well and now make up a larger portion of your portfolio than planned, you might sell some stocks and buy bonds to return to your target allocation.

- Frequency: Many investors rebalance annually or semi-annually, but you may also choose to rebalance whenever your asset allocation drifts more than 5-10% from its original allocation.

7. Managing Risk with Dollar-Cost Averaging

For investors who are worried about market volatility, dollar-cost averaging is an effective strategy. It involves investing a fixed amount of money at regular intervals, regardless of the market’s performance. This approach can reduce the emotional impact of market fluctuations and prevent you from trying to time the market, which is a common mistake for less experienced investors.

8. Staying Focused on Long-Term Goals

It’s easy to get caught up in short-term market movements, but the key to successful investing is staying focused on your long-term goals. Whether you’re investing for retirement, a child’s education, or another milestone, remember that markets have historically recovered from downturns and rewarded patient investors.

- Avoid panic selling: Market corrections and downturns are normal. Reacting emotionally and selling investments during a downturn can lock in losses that could have been recovered over time.

- Review your strategy: Regularly review your investment strategy to ensure it’s still in line with your financial objectives, especially after major life changes like a job loss, marriage, or the birth of a child.

9. Seeking Professional Guidance

If you’re unsure about your risk tolerance or how to create an investment strategy, consider working with a financial advisor. A professional can help assess your risk tolerance, create a tailored investment plan, and keep you on track toward achieving your goals.

10. Conclusion

Creating an investment strategy based on your risk tolerance is key to ensuring that you’re comfortable with the level of risk in your portfolio while still positioning yourself for growth. By understanding your financial goals, time horizon, and emotional response to risk, you can build a strategy that suits your individual needs and helps you achieve long-term success. Remember, diversification and periodic rebalancing are essential for managing risk, no matter your risk tolerance.

How to Diversify Your Investments to Minimize Risk

FAQs

- What is the best way to determine my risk tolerance?

You can determine your risk tolerance by considering your financial goals, investment time horizon, and emotional reactions to market volatility. Some online risk tolerance questionnaires can also help guide you. - How often should I rebalance my portfolio?

Most experts recommend rebalancing your portfolio at least once a year or whenever your asset allocation drifts significantly from your target. - What’s a good investment for conservative investors?

Conservative investors typically focus on low-risk investments like bonds, high-quality dividend stocks, and money market funds to preserve capital. - Is it better to be aggressive or conservative with my investments?

It depends on your financial goals and time horizon. Younger investors with longer time horizons can often afford to be more aggressive, while older investors nearing retirement may prefer a more conservative approach. - Can my risk tolerance change over time?

Yes, your risk tolerance can change as you age, your financial situation evolves, and your investment goals shift. Regularly reviewing and adjusting your strategy is important to ensure it still aligns with your current circumstances.