How to Use the MACD Indicator in Stock Trading

Introduction to the MACD Indicator in Stock Trading

The MACD indicator, short for Moving Average Convergence Divergence, is one of the most popular tools among stock traders. But why is it so widely used? Simply put, it helps traders spot potential buying or selling opportunities by analyzing momentum and trends. Unlike some other indicators, the MACD is versatile, allowing traders to detect the strength and direction of a stock’s movement.

If you want to read same article in hindi click here

Understanding the MACD Components

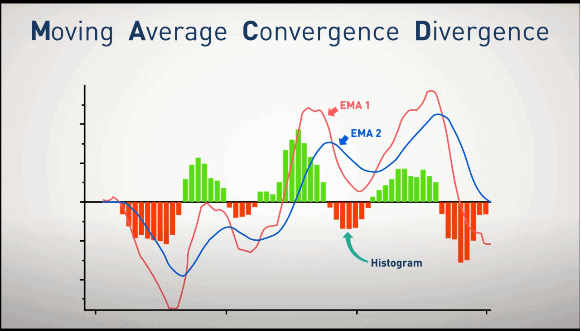

The MACD indicator has three main components: the MACD line, the signal line, and the histogram. To effectively use the MACD, you need to understand what each of these means.

The MACD Line

The MACD line is the core of the indicator. It’s the difference between two exponential moving averages (EMAs), typically the 12-day and 26-day EMAs. This line reflects the short-term momentum of a stock.

The Signal Line

The signal line is the 9-day EMA of the MACD line. It’s plotted alongside the MACD line and serves as a trigger for buy or sell signals. When the MACD line crosses above the signal line, it’s typically seen as a bullish signal. When it crosses below, it’s bearish.

The Histogram

The histogram is the visual representation of the difference between the MACD line and the signal line. The bars above or below the zero line indicate the strength of the movement.

How to Calculate the MACD

Even though most trading platforms calculate the MACD automatically, it’s helpful to know how it’s done.

Exponential Moving Averages (EMAs)

The MACD is based on EMAs, which place more weight on recent price data than simple moving averages (SMAs). The 12-day and 26-day EMAs are the most commonly used.

The Formula Behind MACD

The formula for the MACD line is simple:

MACD Line = 12-day EMA – 26-day EMA

Once you have this, the signal line is just the 9-day EMA of the MACD line. The histogram shows the difference between the MACD line and the signal line.

How to Interpret the MACD Indicator

Now that you know the basics of how the MACD is structured, let’s dive into interpreting it in your trading.

Understanding Crossovers

One of the most commonly used signals in MACD analysis is the crossover. When the MACD line crosses above the signal line, it’s often interpreted as a buying signal, indicating upward momentum. Conversely, when the MACD line crosses below the signal line, it suggests selling.

Divergence Between MACD and Price

Divergence occurs when the direction of the MACD line disagrees with the price movement. If prices are rising but the MACD is falling, this could be a sign that the uptrend is weakening, and a reversal might be on the horizon.

Types of Trading Signals Generated by MACD

There are two primary types of signals that traders look for when using the MACD: bullish and bearish signals.

Bullish Signals

A bullish signal occurs when the MACD line crosses above the signal line. This crossover suggests that momentum is shifting upward, and many traders take this as a cue to buy.

Bearish Signals

A bearish signal happens when the MACD line crosses below the signal line. This is an indication that momentum is weakening, and a downward move could be coming. Many traders use this as a signal to sell or short a stock.

Using the MACD for Different Market Conditions

The MACD works best in trending markets but can also be useful in sideways (ranging) markets if used with caution.

Trending Markets

In a trending market, MACD signals can be more reliable. A strong upward trend will often show consistent MACD line crossovers above the signal line.

Sideways Markets

In sideways markets, the MACD may generate more false signals due to choppiness in price movement. Traders should be cautious and may want to combine the MACD with other indicators.

Combining MACD with Other Indicators

To avoid false signals, many traders combine the MACD with other indicators.

MACD and RSI

The Relative Strength Index (RSI) is often used alongside the MACD. While MACD focuses on momentum, RSI provides information on whether a stock is overbought or oversold.

MACD and Moving Averages

Using simple moving averages (SMAs) in conjunction with MACD can help confirm trends and reduce false signals. For instance, if the MACD gives a bullish signal but the price is below the SMA, it might not be the best time to buy.

Common Mistakes to Avoid with MACD

Even though the MACD is a powerful tool, traders often make mistakes that can lead to losses.

Over-relying on MACD

One common mistake is using the MACD in isolation. While it’s useful, it should not be the only factor in your trading decisions.

Misinterpreting False Signals

False signals are another issue. In choppy or sideways markets, the MACD can generate buy and sell signals that don’t follow through, leading to potential losses.

Tips for Using MACD in Stock Trading

How to Set MACD Parameters for Different Strategies

The default MACD settings (12, 26, 9) work for many traders, but some may adjust these settings for shorter or longer time frames based on their strategy.

Timeframes to Consider When Using MACD

The MACD can be applied to various time frames, but it’s most effective on daily or weekly charts for longer-term trends. Day traders may find it useful on shorter intervals like 5 or 15 minutes, but the risk of false signals is higher.

Conclusion

The MACD indicator is a versatile and valuable tool for stock traders of all levels. By understanding its components, how to interpret the signals, and combining it with other indicators, traders can make more informed decisions and improve their strategies. While the MACD is not foolproof, with practice and caution, it can be a critical part of your trading toolkit.

Understanding Bollinger Bands and Their Application

FAQs

What time frame is best for MACD?

The MACD works best on daily and weekly charts, especially for swing and position traders. Shorter time frames may give more false signals.

Can MACD be used for day trading?

Yes, but be cautious of false signals. It’s often paired with other indicators for more accuracy in day trading.

What is the difference between MACD and RSI?

MACD measures momentum, while RSI gauges whether a stock is overbought or oversold.

How do I know when MACD is giving a false signal?

False signals are common in sideways markets. Combining MACD with other indicators or trading in trending markets can help.

Is MACD suitable for all types of stocks?

While it works on most stocks, MACD performs better on stocks with clear trends.

2 thoughts on “How to Use the MACD Indicator in Stock Trading”