Central banks play a pivotal role in shaping the economy, and their influence on the stock market is profound. Their policies, especially related to interest rates and monetary supply, can either boost market growth or trigger slowdowns. Understanding how central banks operate and impact financial markets is crucial for investors who want to make informed decisions and predict market movements.

If you want to read same article in hindi click here

What is a Central Bank?

A central bank is a national institution that manages a country’s currency, money supply, and interest rates. In many economies, central banks also oversee commercial banks, ensuring financial stability and regulating the banking system. Some of the most influential central banks include:

- The Federal Reserve (Fed) in the United States

- The European Central Bank (ECB)

- The Bank of England

- The Bank of Japan

Main Functions of Central Banks

- Controlling Inflation: Central banks aim to keep inflation at a stable, low level. High inflation can erode purchasing power, while deflation can stall economic growth. They use monetary policy tools to strike a balance between the two.

- Setting Interest Rates: Central banks adjust interest rates to control borrowing costs, which directly affects consumer spending and business investments. Lower interest rates usually lead to economic growth, while higher rates can cool an overheated economy.

- Maintaining Financial Stability: Central banks intervene in financial markets during crises to ensure stability. For instance, they might provide emergency liquidity to banks or regulate money flows to prevent excessive speculation.

- Managing the Money Supply: By controlling the amount of money circulating in the economy, central banks ensure liquidity while avoiding excessive money creation, which could lead to inflation.

How Central Banks Influence the Stock Market

The relationship between central banks and the stock market is intricate. The policies and actions of central banks can create ripple effects that influence stock prices, investor confidence, and overall market sentiment. Here are the main ways central banks impact the stock market:

1. Interest Rates and Stock Market Movements

The most direct way central banks influence the stock market is through setting interest rates. When central banks lower interest rates, borrowing becomes cheaper for businesses and individuals. As a result:

- Businesses can take out loans to expand operations, invest in growth, and boost earnings. This increased activity often leads to higher stock prices.

- Consumers have more disposable income since loans (e.g., mortgages, credit cards) become less expensive, which can lead to higher consumer spending and increased corporate revenues.

Lower interest rates also reduce the attractiveness of bonds, pushing investors toward stocks in search of higher returns. This influx of investment in equities tends to drive stock prices higher.

Conversely, when central banks raise interest rates, borrowing costs increase, consumer spending declines, and businesses face higher expenses. This often leads to reduced corporate profits and can negatively affect stock prices. Investors may also shift their money from stocks to bonds, which offer safer returns in a high-interest environment, further depressing stock market performance.

2. Quantitative Easing (QE) and Stock Market Liquidity

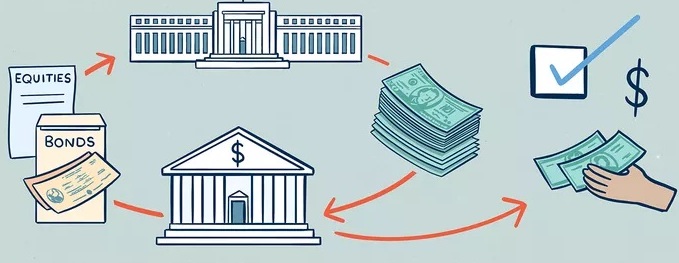

Quantitative easing (QE) is a monetary policy tool used by central banks to inject liquidity into the economy by purchasing financial assets, typically government bonds. QE was used extensively after the 2008 financial crisis and during the COVID-19 pandemic to stabilize economies.

When central banks implement QE:

- They increase the money supply, which often leads to more liquidity in financial markets. This makes borrowing easier for companies and individuals.

- As central banks purchase bonds, bond yields decrease, making stocks more attractive in comparison. This can lead to an increase in stock prices as more investors move into equities in search of higher returns.

In this way, QE tends to boost the stock market. However, it can also create concerns about asset bubbles, where stock prices rise beyond the actual value of the underlying companies.

3. Central Bank Communication and Market Sentiment

Beyond actual policy changes, the way central banks communicate their intentions plays a significant role in shaping stock market sentiment. Investors closely watch central bank announcements, meeting minutes, and press conferences for signals about future policy changes.

For instance:

- Dovish Statements: If a central bank signals that it will keep interest rates low or engage in more stimulus, it is considered “dovish.” This usually leads to a stock market rally as investors anticipate more growth opportunities and easier access to capital.

- Hawkish Statements: If the central bank signals rate hikes or the withdrawal of stimulus, it is considered “hawkish.” This can lead to stock market declines as investors prepare for tighter financial conditions and reduced growth.

Sometimes, markets can experience significant volatility based solely on what central bank officials say, even if no immediate policy action is taken.

4. Inflation Control and Market Reactions

Central banks play a critical role in controlling inflation through monetary policy. Inflation can have a direct impact on corporate profitability and stock prices.

If inflation rises uncontrollably, central banks may raise interest rates to cool down the economy. This action typically slows economic growth, leading to lower corporate earnings, which can negatively affect the stock market.

However, moderate inflation can actually be good for the stock market, as it often signals a growing economy. Central banks aim to maintain this balance, where inflation is neither too high nor too low, to create a favorable environment for businesses and investors.

5. Market Intervention in Times of Crisis

During financial crises or periods of economic uncertainty, central banks often step in with aggressive measures to stabilize the economy. This might include:

- Lowering interest rates to near zero to encourage borrowing and spending.

- Providing emergency liquidity to banks and financial institutions to prevent bankruptcies.

- Launching stimulus programs such as quantitative easing or bond-buying initiatives.

For example, during the 2008 financial crisis and the 2020 COVID-19 pandemic, central banks around the world, including the Federal Reserve, took swift action to lower rates and inject liquidity into financial markets. These actions helped calm investor fears and led to stock market recoveries after sharp downturns.

The Risks of Central Bank Policies

While central bank policies often provide stability, they can also create risks for the stock market. Prolonged periods of low interest rates or excessive quantitative easing can lead to:

- Asset Bubbles: When stock prices rise far beyond their intrinsic value due to cheap money, it can result in an unsustainable bubble that may eventually burst.

- Moral Hazard: Investors may take on more risk, believing that central banks will always step in to save the market during downturns, creating a false sense of security.

- Inflationary Pressures: Excessive liquidity in the market can lead to inflation, reducing the purchasing power of consumers and negatively affecting corporate profits in the long run.

Conclusion

Central banks play a crucial role in shaping the stock market through interest rate policies, quantitative easing, and communication strategies. Their actions directly influence borrowing costs, liquidity, and market sentiment, making them a key factor for investors to monitor. While central bank interventions can stabilize markets during downturns, they can also create risks, such as asset bubbles or inflation. By understanding the role of central banks, investors can better navigate market fluctuations and make informed investment decisions.

How to Research Stocks Like a Professional Investor

FAQs

- How do central banks control interest rates?

Central banks set benchmark interest rates, such as the federal funds rate in the U.S., which influences the cost of borrowing for banks, businesses, and consumers. - What is quantitative easing?

Quantitative easing is a policy where central banks buy government securities to inject liquidity into the economy and lower borrowing costs. - How do central bank announcements affect the stock market?

Central bank announcements can create volatility in the stock market as investors react to changes in interest rate policies or economic forecasts. - Can central banks cause stock market bubbles?

Yes, prolonged periods of low interest rates or excessive liquidity can inflate stock prices, potentially leading to asset bubbles. - What happens to the stock market when central banks raise interest rates?

When central banks raise interest rates, borrowing becomes more expensive, reducing consumer spending and business investment, which can negatively affect the stock market.