Introduction to Bollinger Bands

In the world of trading, Bollinger Bands are one of the most widely used technical analysis tools. Whether you’re a seasoned trader or just dipping your toes into the market, understanding how Bollinger Bands work can provide you with key insights into market trends, volatility, and potential breakouts.

If you want to read same article in hindi click here

What are Bollinger Bands?

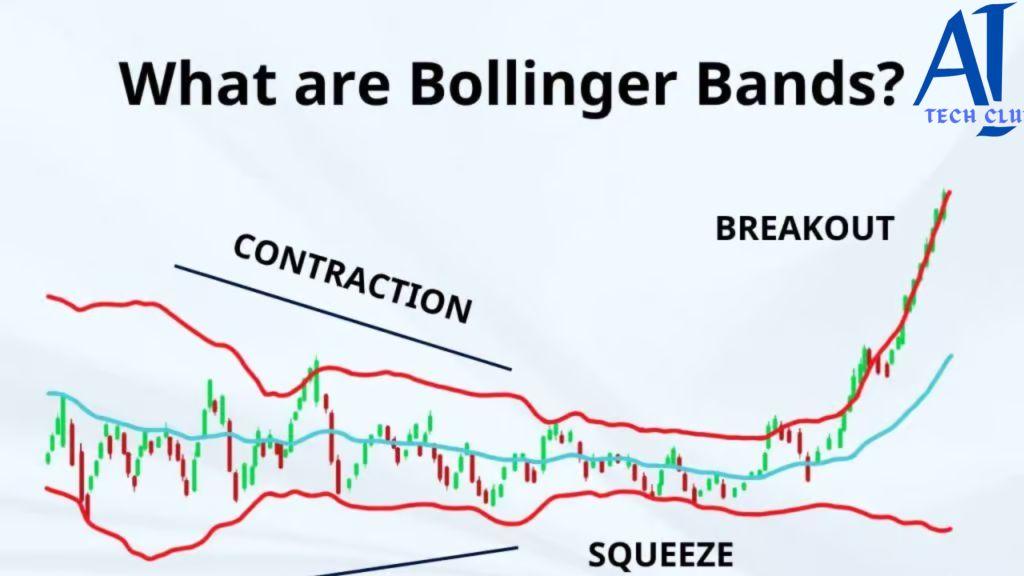

Bollinger Bands are a volatility indicator that consists of three lines plotted on a price chart. These lines include a middle band (usually a simple moving average) and two outer bands that reflect standard deviations from the moving average. The outer bands expand and contract based on market volatility, allowing traders to visually interpret potential price movements.

Historical Background

Bollinger Bands were developed by John Bollinger in the 1980s. Bollinger sought to create a tool that could measure both trend direction and volatility, and over time, his bands have become a staple for traders across various markets. Today, they are used in forex, stocks, and even cryptocurrency trading.

Key Components of Bollinger Bands

To fully understand how Bollinger Bands work, we need to break down their components.

The Middle Band

The middle band is a simple moving average (SMA), typically set to 20 periods. This line represents the average price over a specific period and is used as a baseline to gauge whether prices are high or low relative to recent history.

Upper and Lower Bands

The upper and lower bands are calculated based on standard deviation, a measure of volatility. When the market is more volatile, the bands widen. Conversely, when volatility is low, the bands contract. These bands help traders identify overbought or oversold conditions.

Standard Deviation and Its Role

Standard deviation is crucial in Bollinger Bands because it reflects how much prices deviate from the average. When the standard deviation is high, the market is more volatile, leading to wider bands, and when it’s low, the bands are tighter, indicating less volatility.

How Bollinger Bands Are Calculated

Bollinger Bands may seem complicated, but their calculation is straightforward.

Moving Average Calculation

The middle band, or the moving average, is calculated by averaging the closing prices over a set number of periods (usually 20). This simple calculation forms the foundation of Bollinger Bands.

Standard Deviation in Bollinger Bands

Next, standard deviation is calculated to measure the price range’s variability over the same period. The upper and lower bands are then plotted by adding and subtracting two standard deviations from the middle band.

Interpretation of the Bands

The interpretation of Bollinger Bands is largely visual. If prices touch the upper band, it may indicate that the market is overbought, while contact with the lower band could suggest oversold conditions. However, traders should be cautious and use additional indicators to confirm these signals.

Why Traders Use Bollinger Bands

Bollinger Bands offer a wealth of information to traders, making them a versatile tool in technical analysis.

Identifying Market Volatility

The primary use of Bollinger Bands is to measure market volatility. When the bands contract, it signals a period of low volatility, while expansion signals high volatility. This allows traders to anticipate potential price moves.

Spotting Potential Breakouts

Bollinger Bands can also help traders spot breakouts. A squeeze occurs when the bands contract significantly, signaling a potential breakout. When the price breaks out of the bands, it can indicate a strong move in the direction of the breakout.

Supporting Trading Decisions

By combining Bollinger Bands with other technical indicators, traders can make more informed decisions. For example, if the price touches the upper band and the Relative Strength Index (RSI) is also in the overbought territory, it might signal a selling opportunity.

Bollinger Band Strategies for Traders

There are several common strategies traders use with Bollinger Bands.

Bollinger Band Squeeze

The Bollinger Band Squeeze is a popular strategy that relies on the idea that periods of low volatility are followed by high volatility. When the bands narrow, traders look for a breakout in either direction.

Bollinger Band Breakouts

Breakouts occur when prices move outside of the bands, and traders can use these breakouts to enter trades. A price movement beyond the bands may indicate a continuation of the current trend or a reversal, depending on the market context.

Riding the Trend with Bollinger Bands

Another strategy is to use Bollinger Bands to ride the trend. If the price stays near the upper band during an uptrend or near the lower band during a downtrend, traders can use this as a signal to stay in the trade.

Common Mistakes When Using Bollinger Bands

Although Bollinger Bands are powerful, traders should be aware of common mistakes.

Over-reliance on Bollinger Bands Alone

Bollinger Bands are not a standalone solution. Relying solely on them without considering other indicators or market conditions can lead to poor decisions.

Misinterpreting Volatility Signals

Traders often misinterpret the contraction and expansion of the bands as immediate signals for action. A squeeze doesn’t guarantee a breakout, and a breakout doesn’t always result in a sustained move.

Neglecting Other Indicators

Many traders neglect to combine Bollinger Bands with other indicators like RSI or MACD. Doing so can reduce the effectiveness of their trades, as multiple confirmations increase the accuracy of predictions.

Combining Bollinger Bands with Other Indicators

For better results, traders often combine Bollinger Bands with other tools.

RSI (Relative Strength Index)

The RSI is a momentum indicator that complements Bollinger Bands by confirming overbought or oversold conditions. If both indicators align, traders can have more confidence in their decisions.

MACD (Moving Average Convergence Divergence)

MACD helps to confirm the direction of a trend. When used with Bollinger Bands, it can help filter out false signals and improve the accuracy of trend-following strategies.

Support and Resistance Levels

Combining Bollinger Bands with support and resistance levels allows traders to better understand potential price reversals. For instance, if the price is near a resistance level and touching the upper band, it could be a signal to sell.

Customizing Bollinger Bands for Your Trading Style

Not all traders use Bollinger Bands the same way. You can tailor them to fit your specific trading approach.

Adjusting Timeframes

Short-term traders may prefer

to adjust the moving average and use a shorter timeframe (e.g., 10 periods) for more responsive bands, while long-term traders may benefit from a longer average.

Modifying Standard Deviations

Most traders use two standard deviations, but adjusting this can affect how tightly or loosely the bands fit around the price. More conservative traders might use three standard deviations for fewer signals, while aggressive traders may lower the threshold to increase the frequency of trading opportunities.

Conclusion

Summary of Key Points

Bollinger Bands are a versatile and widely used technical analysis tool that provides traders with valuable insights into market volatility and price trends. By using the moving average as a baseline and the upper and lower bands to identify potential overbought or oversold conditions, Bollinger Bands help traders make informed decisions.

Why Bollinger Bands Matter for Traders

Whether you’re looking to identify volatility, spot breakouts, or combine them with other indicators, Bollinger Bands are essential for understanding market behavior. However, like any tool, they are most effective when used as part of a broader strategy that includes other technical indicators and market context.

How to Use the MACD Indicator in Stock Trading

FAQs

What timeframes work best with Bollinger Bands?

Bollinger Bands can be used on various timeframes depending on the trader’s goals. Day traders often prefer short timeframes like 5- or 15-minute charts, while swing traders may opt for daily or weekly charts.

Can Bollinger Bands predict market trends?

Bollinger Bands don’t predict trends but help identify market conditions. They work best when combined with other trend indicators like moving averages or the MACD.

How do you use Bollinger Bands in a sideways market?

In a sideways market, Bollinger Bands can help identify range-bound trading opportunities. When the price touches the upper or lower band in a ranging market, it might be an opportunity to trade within the range.

What are some common errors traders make with Bollinger Bands?

Common mistakes include relying solely on Bollinger Bands without using other indicators and misinterpreting volatility signals as definite market moves.

Are Bollinger Bands suitable for beginners?

Yes, Bollinger Bands are beginner-friendly and can be used by traders at all levels. However, it’s essential to use them in combination with other tools to avoid false signals.

1 thought on “Understanding Bollinger Bands and Their Application”