Investing in a well-diversified portfolio is a smart way to manage risk and grow your wealth over time. However, as market conditions change and the value of your assets fluctuates, your portfolio may drift away from its original allocation. This is where portfolio rebalancing comes in. But what exactly is portfolio rebalancing, and how can you do it effectively? Let’s dive into the details.

If you want to read same article in hindi click here

What Is Portfolio Rebalancing?

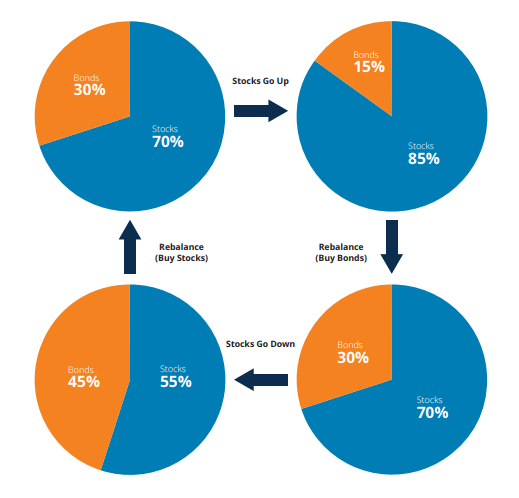

Portfolio rebalancing is the process of realigning the weightings of the assets in your portfolio. This means periodically buying or selling investments to maintain your desired asset allocation, which is the mix of asset classes—such as stocks, bonds, and cash—that match your risk tolerance, investment goals, and time horizon.

For example, if your target allocation is 60% stocks and 40% bonds, and the value of your stocks increases while the value of your bonds decreases, you may end up with a portfolio that’s 70% stocks and 30% bonds. In this case, rebalancing would involve selling some of your stocks and buying more bonds to bring the portfolio back to its original 60/40 allocation.

Why Is Portfolio Rebalancing Important?

There are several key reasons why portfolio rebalancing is important for long-term investment success:

- Managing Risk: Over time, some investments may grow faster than others, causing your portfolio to become overweight in higher-risk assets. Rebalancing helps manage risk by ensuring your portfolio remains aligned with your risk tolerance.

- Maintaining Discipline: Rebalancing forces you to follow a disciplined investment strategy. It encourages you to buy low and sell high by reducing exposure to overperforming assets and increasing exposure to underperforming ones.

- Aligning with Goals: As your life circumstances change (e.g., nearing retirement, changing income levels), rebalancing allows you to adjust your portfolio to meet your evolving financial goals.

- Avoiding Emotional Decisions: By sticking to a regular rebalancing schedule, you avoid the temptation to make emotional, short-term decisions based on market volatility or fear.

How to Rebalance Your Portfolio

Now that you understand the importance of rebalancing, let’s go over the steps you can take to effectively rebalance your portfolio.

1. Review Your Target Asset Allocation

Before you start rebalancing, revisit your target asset allocation. This is the mix of stocks, bonds, cash, and other investments that aligns with your investment strategy, risk tolerance, and time horizon. For example, a younger investor may have a more aggressive allocation with a higher percentage of stocks, while someone nearing retirement may prefer a more conservative allocation with more bonds and cash.

2. Monitor Your Portfolio

Track your portfolio’s performance to see if it has drifted from your target allocation. You can do this manually by checking the values of each asset in your portfolio or using online tools and apps that automate this process. Pay attention to significant changes in the percentage of each asset class due to market movements.

3. Set a Rebalancing Threshold

Many investors set a threshold that determines when to rebalance, such as a 5% or 10% deviation from the target allocation. For example, if your target allocation is 60% stocks and 40% bonds, you might decide to rebalance if your stock allocation exceeds 65% or drops below 55%. Setting a clear threshold helps you avoid overtrading and minimizes costs.

4. Buy or Sell to Rebalance

Once you’ve identified that your portfolio needs rebalancing, you can take action by buying or selling assets. If stocks have outperformed and now make up too much of your portfolio, sell some of your stock holdings and use the proceeds to buy bonds or other underweighted assets. Similarly, if bonds have outperformed, sell some bonds and buy more stocks to maintain your target allocation.

5. Automate Rebalancing (If Possible)

Some brokerage firms and robo-advisors offer automatic rebalancing features, where your portfolio is automatically rebalanced at regular intervals or when it exceeds a certain threshold. This can be a convenient option if you prefer a hands-off approach to managing your investments.

6. Consider Tax Implications

When rebalancing in taxable accounts (as opposed to tax-deferred accounts like IRAs or 401(k)s), selling assets may trigger capital gains taxes. To minimize the tax impact, consider using tax-loss harvesting, which involves selling investments that have lost value to offset gains from selling other assets. You might also focus on rebalancing within tax-advantaged accounts where transactions do not have immediate tax consequences.

7. Rebalance Periodically

How often should you rebalance? There’s no one-size-fits-all answer, but many experts recommend rebalancing at least once a year or whenever your asset allocation drifts beyond your set threshold. Some investors choose to rebalance quarterly, while others prefer to check their portfolios semi-annually or annually.

Rebalancing Strategies

There are different strategies you can use to rebalance your portfolio, depending on your preferences and circumstances:

- Calendar-Based Rebalancing: This involves rebalancing your portfolio on a set schedule, such as every quarter, semi-annually, or annually. This method is simple and consistent, but it may result in rebalancing even when the portfolio hasn’t drifted significantly.

- Threshold-Based Rebalancing: This approach focuses on rebalancing only when your portfolio deviates by a certain percentage (e.g., 5% or 10%) from the target allocation. It’s more flexible and allows you to react to significant changes in asset values.

- Hybrid Approach: Some investors combine calendar-based and threshold-based rebalancing. For instance, you might set a schedule to review your portfolio annually but only rebalance if your asset allocation has drifted by more than a specific percentage.

Conclusion

Portfolio rebalancing is a crucial part of maintaining a disciplined investment strategy. It helps you manage risk, stay aligned with your goals, and avoid emotional decision-making in the face of market volatility. By regularly reviewing your asset allocation, setting a rebalancing threshold, and considering tax implications, you can keep your portfolio on track and optimized for long-term success.

How to Spot Emerging Market Trends Before Everyone Else

FAQs

- How often should I rebalance my portfolio?

Many experts recommend rebalancing at least once a year or when your asset allocation drifts significantly from your target. - Is portfolio rebalancing necessary?

Yes, rebalancing is necessary to manage risk and ensure your portfolio stays aligned with your investment goals and risk tolerance. - Does rebalancing cost money?

Yes, rebalancing may incur transaction fees or capital gains taxes, especially in taxable accounts. It’s important to consider these costs when rebalancing. - Can I automate portfolio rebalancing?

Yes, many brokerage firms and robo-advisors offer automated rebalancing services, which can be convenient for hands-off investors. - Should I rebalance during a market downturn?

Yes, rebalancing during a downturn can help you maintain your desired asset allocation and potentially take advantage of lower asset prices.